When investing in the technology sector, it pays to look at data and trends. Drone stocks are one concentrated in one of the most consistent sectors in the economy over the past few years. They’re getting more commercial use as advancements in drones make them better options for several industries. Adoption of drones is predicted to continue because of their efficiency.

The commercial drone market as a whole is also seeing a rise. Drones have more capabilities now, and it’s predicted that their growth will continue until 2030. As an investor, this is news that we want to hear, and getting into drone stocks may be one of the best choices to make this year.

The Drone Stock Market as a Whole

There’s a misconception that drones are only for hobbyist consumers or military technology. The restrictions from drone usage have eased in the last few years thanks to advancements that make drone piloting safer. The majority of growth in the drone market has mainly been because of commercial applications. Around 70% of the entire market is dominated by commercial drone manufacturing and services.

The reason? More and more industries are adopting drone technology. You may not have even heard of drone usage in infrastructure, agriculture, and 3D mapping, yet they are ever-present and growing. Many drone-related companies have become viable and lucrative, including:

- Drone manufacturing

- Drone operation

- Data management for drones

- Drone maintenance

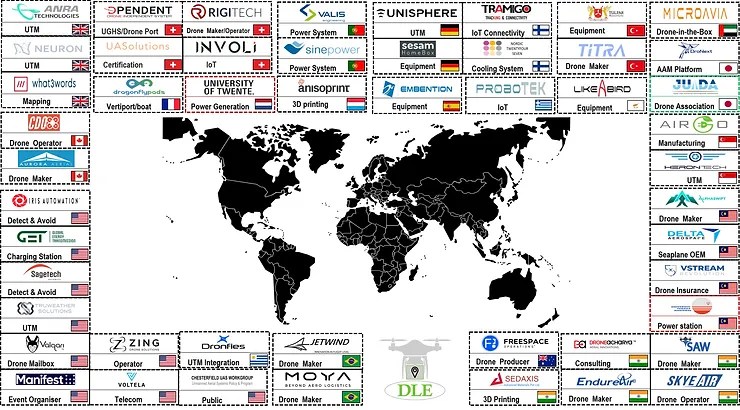

Experts believe that more drone companies will continue to enter the market. Established companies are a good investment because their longevity is a good sign for continued growth. Companies are utilizing their drones in numerous ways, such as:

- Mapping: Drones are more efficient than surveyors for mapping. They can navigate hard-to-reach areas faster and can reach farther places faster, providing data before any human can arrive.

- Reach: There are many hard-to-reach locations in various parts of the world. For example, drones today are being used to fly medicine and food to impoverished locations in Africa.

- Deliveries: Drone deliveries are probably one of the industries that most people hear about when it comes to its application. Companies like Amazon have invested in drones to help supplement their delivery workforce. We may reach a point where they become the majority soon.

- Surveying: Scientists and engineers use drones to survey hard-to-reach or contaminated areas. Imagine being able to check the infrastructure in a tall building within minutes. They can also travel offshore, through large grids, and detect problems faster than humans.

- Internet: Another interesting application is drones becoming waypoints to amplify internet signals. Being able to provide internet through a drone is a less expensive method than wiring, and it’s also easier to maintain.

With all these applications, it’s no wonder why the drone industry continues to grow at a rapid pace. The only question is how to begin investing in this market.

How to Invest in Drone Stocks

There are two main ways to invest in drone stocks. The first is by choosing one (or several) stocks you’re interested in and have high hopes of rising in the future.

You may want to focus on a single application of drones, or diversify and apply your investment to multiple industries. Some people may want to focus on companies that provide drone services to the oil and gas industry. Others may want companies adopting drones for home delivery. Another option is electric vehicle takeoff and landing (eVTOL) specialists. You can also look for companies that work on specific drone technology like AI, hardware, and software.

The second option is investing in a drone technology-focused ETF. This investment acts similar to a mutual fund, but you’re investing in dozens of different drone stocks as a part of a single fund. ETF can be a way to place your money in the industry without necessarily risking it in only certain companies.

Both investment methods have pros and cons. ETFs tend to have a lower risk, but slower growth. On the other hand, stocks can yield higher returns, but there’s a lot more risk because you’re dependent on the one stock performing well. Since drones are projected to grow over the long term, holding your investment for five or more years will improve your chances of profit.

Stocks to Watch

While there are many drone companies in the stock market, several names stand out. These are some of the stocks that experts and investors are talking about the most:

- ALPP: Alpine 4 holdings has many subsidiaries that focus on drone technology. They manufacture drone defense systems, mobility, circuit boards, and more. One of their biggest developments is the creation of solid-state batteries, which make drones last longer in operation.

- UAVS: AgEagle Aerial System specializes in creating drones used by several industries. They provide drone services to the government, agriculture, construction, and energy fields. Not only do they build the drones themselves, but they’re also responsible for hardware and sensors.

- DPRO: Draganfly is probably one of the oldest companies to tackle unmanned aerial vehicles (UAVs). They handle everything from development to operations. Some of the industries they serve include the military, insurance, and public safety.

- RCAT: Red Cat specializes in developing and advancing drone artificial intelligence. They’ve developed advanced aerial systems used by the US military, and they’re one of the pioneers of night surveillance drones. Many of their products are used for national defense.

- AVAV: AeroVironment is another military-focused company focused on developing unmanned aircraft systems. They’ve created ground operation systems and drones specializing in reconnaissance, surveillance, and more.

The Bottom Line

Drones are becoming more mainstream, and many people aren’t aware of their widespread adoption. The crazy thing is that it’s just the tip of the iceberg, and developers are finding more applications for these unmanned vehicles. Drone technology will change the way we operate in numerous industries over time.

Think of drones like mobile phones or computers during the early days. These are technologies that have become a normal part of our life. As investors, drones are a great opportunity to consider as the industry rises.